The California housing market is experiencing a sluggish beginning to the season, with home sales seeing a year-over-year decline for the second time in four months. This slowdown is attributed to a combination of elevated interest rates and persistent economic uncertainty. The condominium market, often a more accessible entry point for first-time buyers, has also seen a softening as affordability and insurability black lists continue to widen.

Market at a Glance

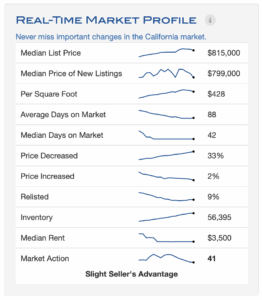

Recent data from the week ending May 31, 2025, shows a dynamic yet challenging market. On a daily basis, there were 556 closed sales, 548 pending sales, and 768 new listings. The median list price for a home in California has now reached $815,000, with the price per square foot at $428. Homes are sitting on the market for an average of 88 days, with a median of 42 days.

Despite the high prices, the market action index indicates a “Slight Seller’s Advantage” at 41, a figure that has remained steady from the previous month. This suggests that while sales have slowed, inventory remains relatively tight, keeping prices firm. Total inventory across the state is currently holding at around 56,395 homes.

REALTORS® Activity and Outlook

In the previous week, real estate professionals saw a mixed bag of activity. While 33.8% of REALTORS® listed a property, a 10% increase, and 24.6% closed a sale, up 12.1%, the number of those entering escrow saw a slight dip of 0.4% to 13.8%.

Looking ahead, REALTOR® sentiment reflects the market’s uncertainty. A significant 46.9% of REALTORS® anticipate that listings will increase, a rise of 3.7% from the previous quarter’s sentiment. However, there is less optimism about sales and prices. Only 23.4% expect sales to go up, a 4.1% decrease in positive sentiment, and a mere 9.4% believe prices will rise, a substantial 9.4% drop in confidence from the last quarter.

A Look at Housing Affordability

A significant factor contributing to the market’s slow start is the increasing difficulty for many Californians to afford a home.

In 2024, less than one-fifth (18%) of all Californian households could afford to purchase a median-priced home of $865,440. To afford such a home, a minimum annual income of $221,200 is required to manage the estimated monthly payment of $5,530, assuming a 20% down payment and a 6.84% interest rate.

The ability to afford a home varies across different ethnic groups. In 2024, 21% of White households could afford a median-priced home, compared to 27% of Asian households, 10% of Black households, and 9% of Hispanic/Latino households.

Economic Headwinds

The broader economic landscape presents a mixed but cautious outlook. While consumer confidence has seen a partial rebound, CEO confidence has fallen due to concerns over geopolitical instability and tariffs, with many predicting a recession in the next 12 to 18 months. Although a key inflation gauge is easing, potential price hikes from major retailers could reverse this trend. These factors are keeping mortgage rates high, causing a stall in the housing market as both buyers and developers adopt a “wait and see” approach, evidenced by a third consecutive monthly decline in construction spending.

Sourced from the California Association of REALTORS® and Altos Research.