The predictions of the real estate market have been about as accurate as the local weather forecast in areas without Doppler Radar.

Two headlines in real estate, really?!

Yes.

The summary? Solid demand with low inventory means fewer options for real estate buyers AND a tale of two markets.

In a recent WSJ article, Nicole Friedman wrote the United States is a country of two housing markets. In one, home prices are falling from a year ago. In the other, they’re still posting annual gains. That division runs right down the center of the U.S. She listed – with data from Black Knight – the top 10 markets with the largest price increases between February 2020 and January 2023:

- Tampa up 59%

- Miami up 53%

- Austin, Texas, up 50%

- Jacksonville up 50%

- Charlotte up 49%

- Atlanta up 49%

- Nashville up 48%

- Orlando up 48%

- Raleigh up 47%

- Phoenix up 47%

Nicole’s article points out that real estate markets are hyper-local and geography-specific. According to Michael Simonsen from Altos Research, we continue to see a seller’s market across the US. You can see the National numbers – on this link – and type in your own zip code for a local view.

In looking at this week’s Altos data, the top 10 markets with the most listings absorbed – it’s a Texas sweep:

- Houston

- San Antonio

- Fort Worth (Does Fort Worth Ever Cross Your Mind?)

- Austin

- Dallas

- Orlando

- El Paso

- Denver

- Minneapolis

- Lubbock (Buddy Holly and Mac Davis would like this)

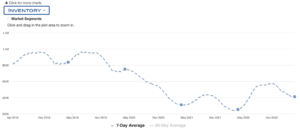

I observed this week on a National basis another 1% drop in inventory for sale at a time when inventory is typically rising by 1% or more each week. This, in my view, is a leading indicator of a supply-constrained market for the Spring buying season. Many homeowners have a current mortgage rate below 4%, and many don’t want to sell their current rate and pay a higher rate for a different house.

Implication? It’s going to be a great time for remodeling contractors.

Many homeowners are also sitting on large cushions of equity, and the institutional investors show no sign of liquidating inventory, which is likely to prevent any big wave of foreclosures and distressed sales.

In many markets across the US, housing demand is high enough for sellers to command pricing. In fact, the latest percentage of listed homes with a price decline dropped this week to 30.5% when just a month ago, it was nearly 40%. Investors and buyers who were sitting on the fence missed an opportunity back in November and December.

In other news, according to Altos, the median price of a new listing his week rose to $437,500 across the US, while the median rent was $2,250. The headlines will be hard to interpret as some are comparing to last year’s unprecedented price increases. The data shows increasing prices on a National basis but not near the pace of last year. My view? The unprecedented rise in mortgage rates has softened demand but not enough to balance the market.

The solution? Building, renovation, and conversation of mall and unused office space for residential use. The issue, according to Nicole, is Home builders have been hampered by supply-chain issues and labor shortages. Yet, Jonathan Lanser, a real estate and business journalist for the Orange County Register, recently reported that new home builders gained 2.8% in market share. Yet is it enough? I say no. It seems to me from a National, Regional, and local City perspective, we need to address housing policy to place this vital sector of the US economy in a position to enable the American dream vs. destroying it.