The Shifting Landscape

Many of you have experienced a unique year. Your gross income has been a challenge, unit sales have seen a notable decline. This trend is starting to shift.

Back to Basics: A Timeless Approach

To navigate this changing market, we must return to fundamental principles. A crucial element is diversifying lead sources. Aim for at least four to six reliable channels to ensure a steady stream of potential clients. Additionally, our 90-day to recruiting stability plan and our “Real Estate Recruiting Playbook” offer structured approaches to maintain consistency and achieve success.

The Power of Responsiveness

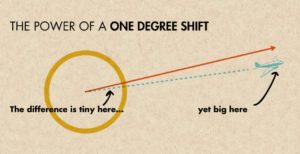

A recent analysis of our top producers revealed a striking difference in responsiveness. These top performers were three times more likely to answer calls and return messages promptly compared to those struggling. This highlights the importance of timely communication in building trust and securing deals.

Good or great the choice for 2025 is yours and mine to make.